Featured

Whichever your situation is, think about talking to a certified credit therapist, a personal bankruptcy attorney, or a licensed debt professional before progressing. They can aid you obtain a complete understanding of your financial resources and alternatives so you're far better prepared to choose. One more aspect that influences your choices is the kind of debt you have.

Kevin Briggs was an effective landlord with a six-figure revenue, however after a year of pandemic obstacles, he found himself in 2021 with $45,000 in credit report card financial obligation."Much less than 3 years later on, Briggs had actually removed his credit score card financial debt, thanks to that rescue a brand-new nonprofit financial obligation relief program from InCharge Financial debt Solutions called "Credit report Card Debt Forgiveness."Credit History Card Financial debt Forgiveness, also understood as the Less Than Full Equilibrium program, is financial debt relief for individuals who have not been able to make credit rating card payments for six months and creditors have actually charged off their accounts, or are about to.

The catch is that not-for-profit Credit history Card Financial obligation Forgiveness isn't for every person. InCharge Financial obligation Solutions is one of them.

The Credit Rating Card Mercy Program is for individuals that are so much behind on credit score card payments that they are in severe economic problem, possibly facing bankruptcy, and do not have the revenue to catch up."The program is especially made to assist clients whose accounts have actually been billed off," Mostafa Imakhchachen, customer treatment professional at InCharge Financial obligation Solutions, said.

Everything about Free Accessible Financial Literacy Materials for Individuals

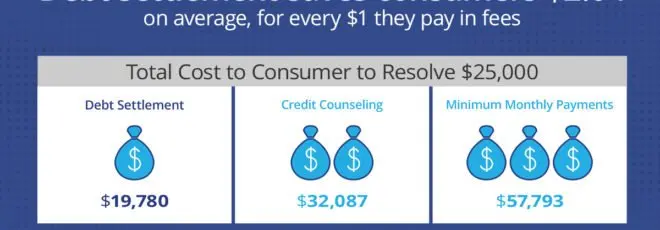

Lenders who get involved have agreed with the nonprofit credit score counseling firm to approve 50%-60% of what is owed in fixed month-to-month payments over 36 months. The set repayments imply you know exactly just how much you'll pay over the settlement duration. No passion is charged on the balances during the reward period, so the settlements and amount owed do not alter.

Latest Posts

The Greatest Guide To What Sets APFSC Apart in Competing Pay Off Credit Cards If You're Spiraling Out of Control : APFSC Organizations

5 Simple Techniques For Chapter 13 Basics Before You Decide

Unknown Facts About Immediate Effects on Personal Credit Score

More

Latest Posts

5 Simple Techniques For Chapter 13 Basics Before You Decide

Unknown Facts About Immediate Effects on Personal Credit Score